Meet Garrett Leroux, Wealth Advisor, who specializes in retirement planning for Chevron Employees.

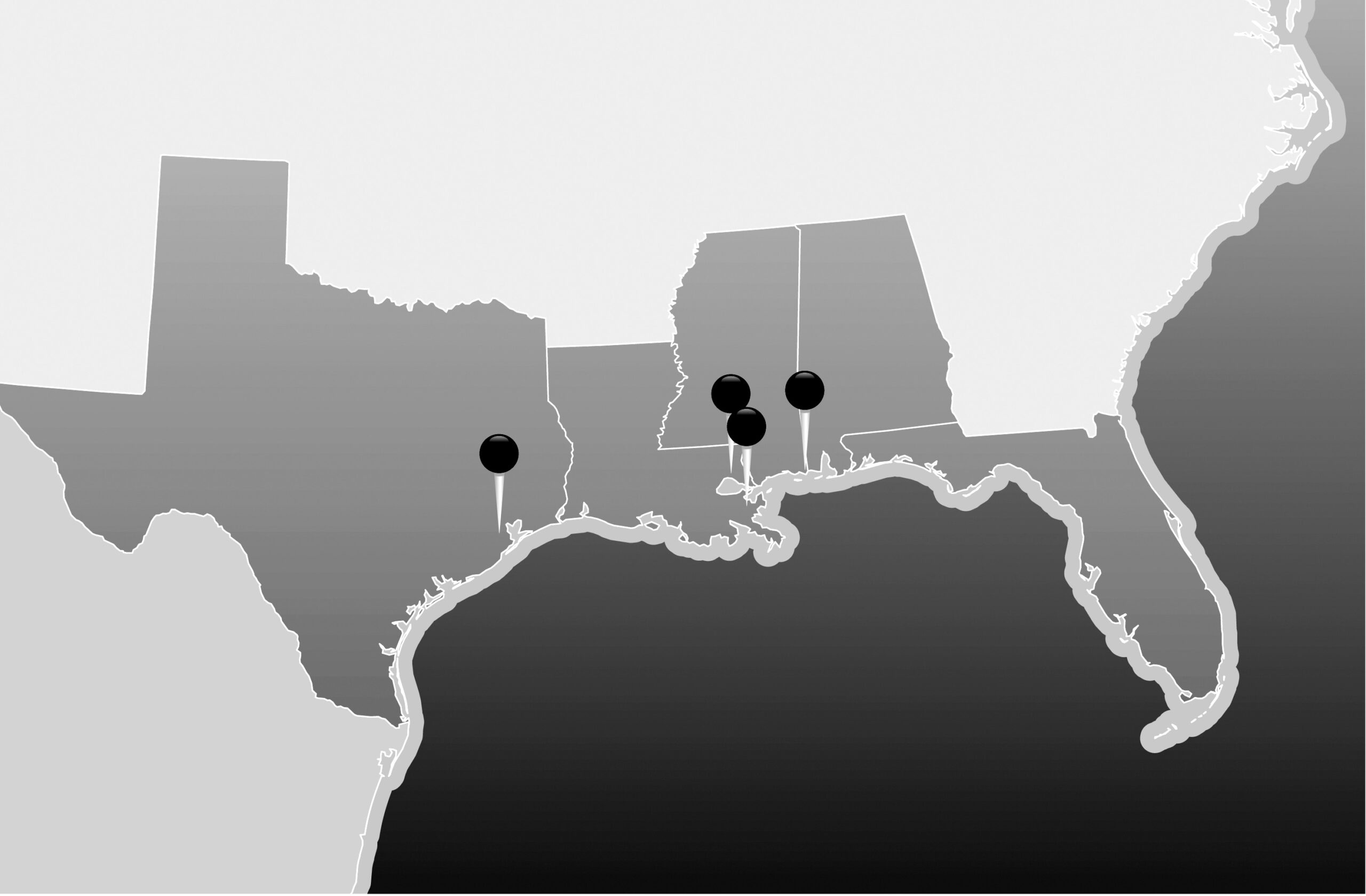

Garrett brings a wealth of expertise gained through his CERTIFIED FINANCIAL PLANNER™ Designation and his tenure in the financial services industry. A proud Louisiana native and an alumnus of Louisiana State University, Garrett earned his degree in Finance with a specialized focus on Financial Planning.

Notably, he also served as an Infantryman in the United States Marine Corps, a testament to his dedication and discipline. Garrett enjoys traveling, live music, and Brazilian Jiu-Jitsu training when he is not hard at work for clients.