Quarterly Market Commentary, Q2 2024

Data sourced from Ycharts and Factset, as of 6/30/2024

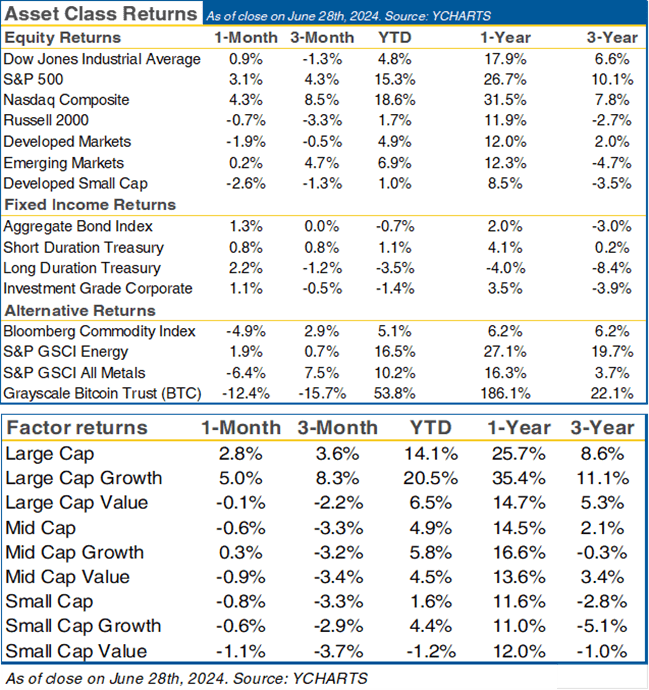

Equity returns were strong but concentrated in the second quarter as large gains from Nvidia (+36%), Apple (+24%), and AMZN (+20%), $2-3 trillion market cap companies, skewed index returns higher. The equal-weight S&P 500 was down 2% and the Russell 2000 was down over 3%. While almost 80% of S&P constituents had positive momentum going into the quarter, less than half maintained momentum at the end of Q2.

Technology adjacent and copper/aluminum stocks outperformed while economically sensitive industries such as banks, railroads, machinery, and energy underperformed. The main macro catalysts during the quarter were a re-pricing of Fed rate cut expectations, increased focus on a weakening consumer, and a slew of weaker than expected economic releases despite solid earnings growth.

Fed officials continued their rhetoric indicating the need for “greater” confidence in inflation heading toward 2% before they cut and lowered their rate cut forecast to one by year end, down from three. This is not a huge surprise considering the slew of higher than expected inflation reports in Q1 which effectively “reset the clock” for rate cuts. However, inflation reports in Q2 were more in line with a disinflationary trend toward 2%, while shelter inflation continues to contribute over half of year over year inflation.

Investor expectations for recession picked up during the quarter; weak retail sales reports and numerous comments from retail executives characterizing the consumer as “trading down,” and “value conscious,” spooked the market. Survey data also shows a slowing economy. Both services and manufacturing PMIs dipped into contraction territory during the quarter, and Q1 GDP was well below expectations. The S&P 500’s earnings grew 5.8% year over year, beating expectations of 3.4%; however, after stripping out the “Mag-7” mega-caps, earnings declined by 1.7%. Analysts still expect double digit earnings growth this year and over 14% growth in 2025.

Turning the Corner

In previous commentaries, I have described the US economy’s recent trends as a “return to normal.” Remember that phrase from Covid? Unfortunately, Covid disrupted many areas of our lives, including across the economy in many industries, and affected the trends of consumer and business spending. Covid also affected fiscal policy, the path of interest rates, current price levels, and the labor market. As time goes on, this disruption fades and markets fall back into equilibrium. Falling back into equilibrium can look very similar to a weakening economy when you start at a faster than average pace.

The labor market is a great example of normalization that is being mistaken for weakening. The unemployment rate was at 3.5% entering covid, it spiked to nearly 15%, then trended lower to its trough at 3.4% and has now trended back up over the last year to 4.1%. Covid disrupted the labor market by causing mass retirements, a mortality-driven decline in the labor force, and a large increase in labor demand due to stimulus measures. Now, covid stimulus measures are over and labor supply is increasing as population and immigration growth rebound. Without the boost from covid-era fiscal stimulus, labor demand fell, as we would expect.

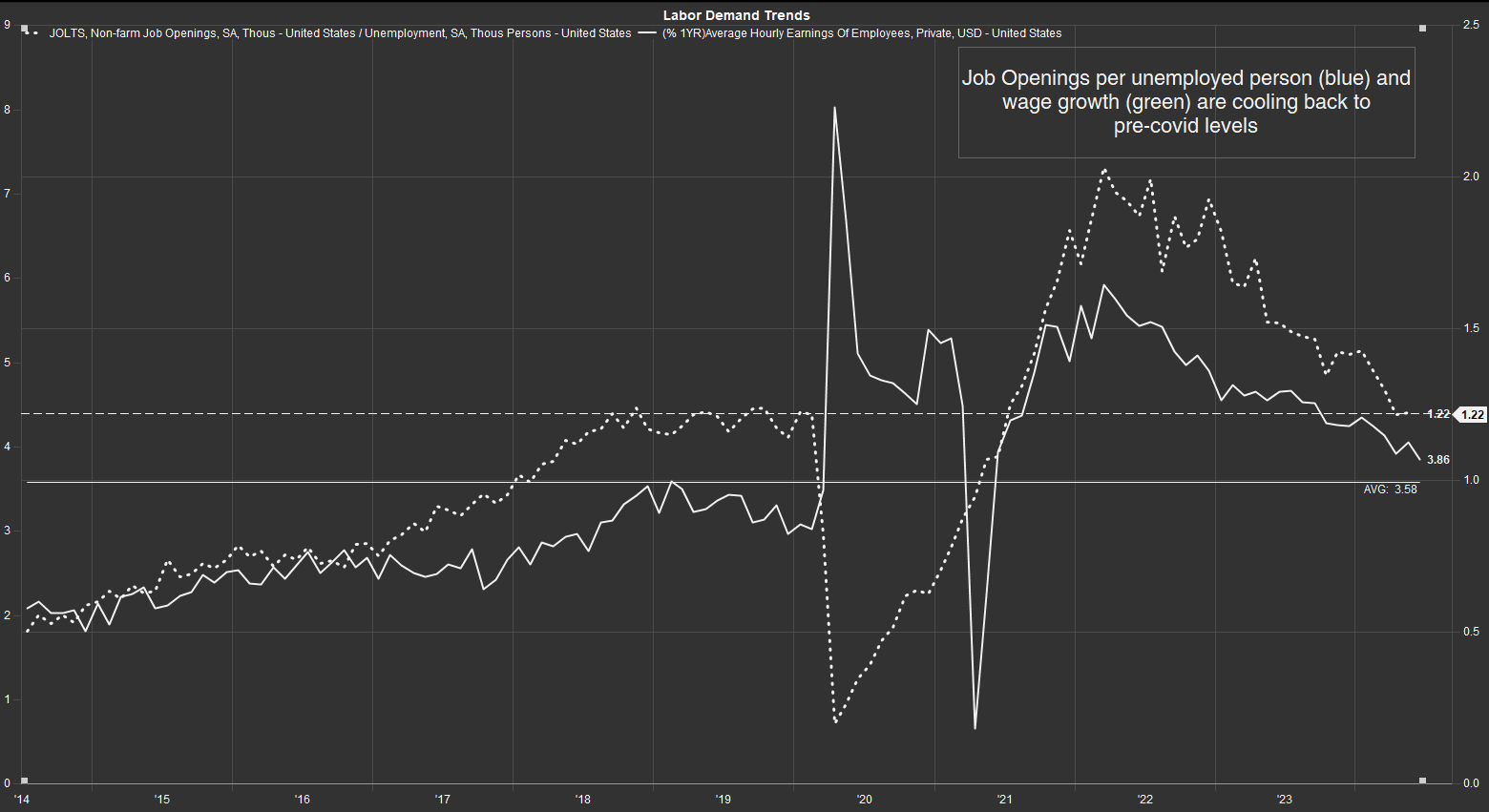

As you can see in the chart below, measures of labor demand like wage growth and the number of unemployed people per job opening, are falling rapidly, but off extremely high levels, and they are not falling to low levels, but rather back to “normal” levels from pre-covid. While this could be a sign of weakness to come, I don’t believe so. Companies may not have an appetite for new labor, but they continue to hoard labor. Layoffs are low, hours worked across industries are steady at healthy levels, and the economy continues to add an average of ~200k jobs per month. The labor market remains healthy and is supportive of a growing economy, even if it’s not as strong as a couple of years ago.

Please note that in this graph, the dotted line is job openings per unemployed person, and the solid line is wage growth.

While we have witnessed weakness in several areas of the economy over the last few years, the weakness was not simultaneous, but rather individual downturns isolated within industries and offset by strength in other areas of the economy, something economists are calling a “rolling recession.” We believe the idea of the US economy undergoing a rolling recession instead of a broad recession has merit and explains why we have yet to experience the broad-based decline many economists expected.

While the avoidance of a broad recession is not a foregone conclusion, we believe the market is overzealously pricing in that possibility, which we think creates opportunities for active investors willing to make tactical allocation adjustments. One opportunity is the persistent valuation discount and underperformance of everything except the Mag-7. Small and mid-caps have historically traded at a premium relative to their earnings compared to their large cap counterparts because investors generally expect mid and small cap companies to have a longer runway for growth and therefore deserve a premium.

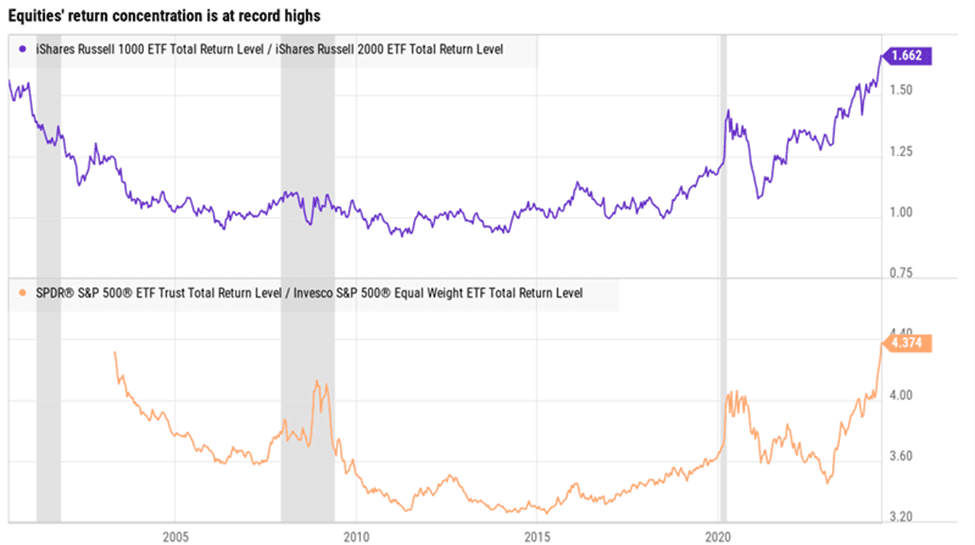

However, over the last couple of years, returns have been concentrated within a few mega cap names (NVDA, AAPL, MSFT, META, etc). Part of this is justified due to the greater AI opportunity within mega-caps, others are temporary, such as higher interest rates pressuring profitability of mid and small cap companies due to higher levels of debt. Mid and small caps also have higher allocations to cyclical sectors like industrials, energy, materials, and banks, which have underperformed in an environment in which investors expect a weak economy.

The graph above from YCharts shows the ratio of large cap total returns to the returns of small caps (top) and the ratio of the S&P 500, which is market cap weighted and therefore mega-caps have a higher allocation, to the equal weight S&P 500, where all stocks have the same allocation. As you can see, the relative returns have now surpassed early 2000s highs. The same pattern exists when looking at relative valuation. In the early 2000s, small caps went on to outperform materially, while the S&P 500 struggled. We think we could be entering a period where this reverses for a few reasons. First, conditions are aligning for the Fed to begin cutting rates later this year, current market pricing implies the first cut will occur in September. Second, if we avoid recession, the market will re-price cyclical sectors more represented in mid/small caps higher, as earnings estimates must reflect ongoing strength in the economy. Lastly, we believe the AI story will have multiples phases, including the buildout of electricity generation and transmission to power ever-growing power needs of data centers/AI applications, which means benefits will begin to seep into areas other than mega-caps. Even if our predictions are misplaced, valuations across asset classes justify prudent rebalancing right now.

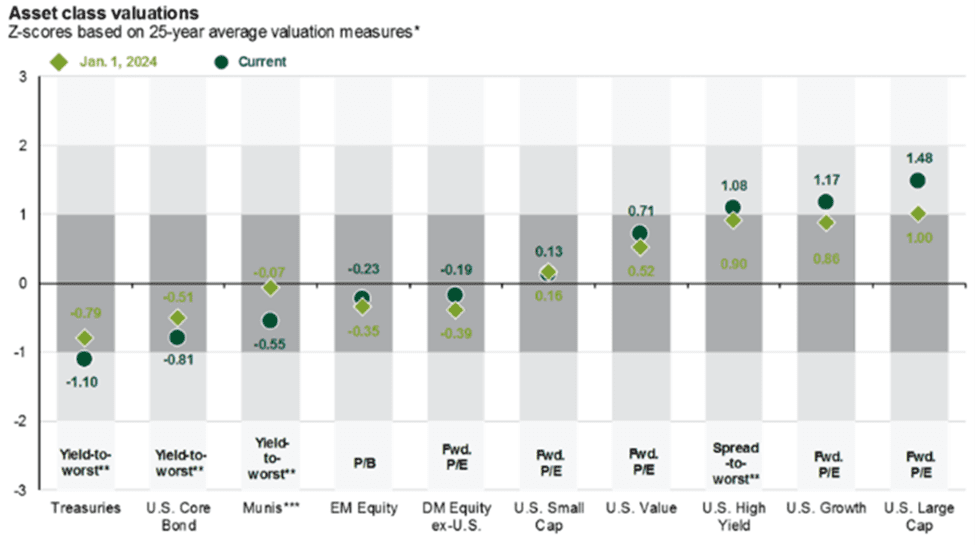

The above graphic from JP Morgan Asset Management shows the current valuation of various asset classes compared to their historical averages and ranges. Large cap growth (i.e.- mega caps) are historically expensive, while all other assets are trading in line with historical averages, and in the case of bonds, below. Given lopsided valuation, improving economic circumstances, and a forthcoming Fed rate cutting cycle, we think taking chips away from large caps and allocating that across the portfolio gives investors better value, higher diversification, and a better set up for the next 12-18 months.

Markets are notorious for moving in cycles with frequent changes in leadership. We welcome the abnormally high returns in tech/mega-cap, but we think now is a good time to be cognizant of market rotations, high concentration within large cap indices, and the relative cheapness of literally everything else. While the data provided herein is as of June 30th, 2024, we have already seen the beginning stages of this rotation take place in July.